Norsk e-Fuel

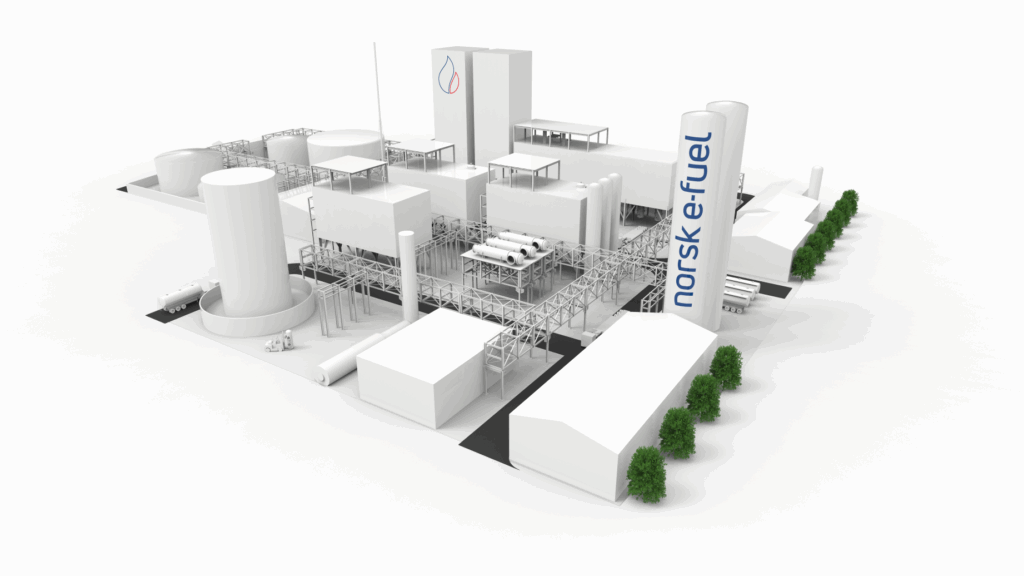

Norsk e-Fuel is building one of Europe’s first large-scale power-to-liquid plants, designed to produce around 80,000 tonnes of e-fuels (of which about 80% will be SAF) each year at the Port of Rauma in Finland.

Project Rauma – expanding Sustainable Aviation Fuel in the Nordics

Norsk e-Fuel is building one of Europe’s first large-scale power-to-liquid plants, designed to produce around 80,000 tonnes of e-fuels (of which about 80% will be SAF) each year at the Port of Rauma in Finland.

| KEY FACTS | |

|---|---|

| Official project name | Project Rauma |

| Location | Port of Rauma, Finland |

| Project stage | Development; pre-FEED |

| Sector | Aviation, Chemicals |

| Customer | Offtake flexibility for Norwegian Air Shuttle, Boeing, Cargolux |

| Partners/Investors | Sunfire, Climeworks, Paul Wurth (SMS Group), Valinor, Prime |

| Capacity | 8,000 tonnes of e-fuels (of which 80% will be SAF) each year |

| Key milestones | – Announced 2024 – pre-FEED underway – FEED expected 2026 – FID targeted 2027 |

Company vision and motivation

Norsk e-Fuel was founded with the vision of industrialising power-to-liquid (PtL) technology to deliver large-scale sustainable aviation fuel (e-SAF) production. Aviation is one of the hardest sectors to decarbonise and demand for sustainable fuels is set to grow with the advent of European and global mandates. Producing e-SAF, a synthetic fuel, locally reduces Europe’s dependence on imported fossil fuels, strengthens energy security and generates jobs and investment in regions that often face industrial decline.

The company is pursuing a portfolio strategy across the Nordics: Rauma in western Finland, Mosjøen in Norway, Imatra in eastern Finland and Alby, Ånge municipality in Sweden. This strategy is designed to spread risk, accelerate learning and ensure momentum in the event a particular project faces setbacks. The ambition is to bring as many as three plants into operation by 2032, with a combined capacity of around 250 million litres or 200,000 tonnes of e-fuels annually.

e-SAF is produced using renewable electricity, water and carbon dioxide captured via a point of source capture or direct air capture. e-SAF is seen as a viable long-term solution to sustainable aviation as it is more resource efficient than biomass alternatives and promotes a circular reuse of CO2. It is a ‘drop-in’ solution that can be blended with Jet A fuel and works for aircraft flying today and existing fuelling infrastructure and pipelines, so avoids the need for costly infrastructure development.

Recent geopolitical developments have impacted the energy sector’s strategic vision, with energy independence and security now taking priority.

— Luisa Biesold

Norsk e-Fuel Head of Corporate Development

The Rauma Project

Rauma is the company’s first international expansion site and a demonstration of its diversified project pipeline. The Port of Rauma was chosen for its combination of industrial infrastructure, logistics advantages and political support. The 14-hectare site offers direct sea and rail connections, is close to existing industries and has access to sufficient power for new industrial use.

The project is at this stage being developed in collaboration with Fortum, one of Finland’s leading energy companies, for the grid connection and with the Port of Rauma. The municipality is very engaged and constructive, actively supporting the permitting and development process.

With a planned capacity of 75–80,000 tonnes of e-fuels per year, around 80% of which will be e-SAF, Rauma will demonstrate how PtL can be scaled from pilot to commercial size in Europe. Finland’s fossil-free energy mix of nuclear and renewables can provide the reliable, clean power base that such a plant requires.

As PtX technologies mature and are adopted by the market, the focus shifts towards practical considerations and implementation challenges.

— Luisa Biesold

Norsk e-Fuel Head of Corporate Development

A reliable supply of liquid CO2 at the right price is also crucial. Norsk are CO2-origin-agnostic, prioritising EU compliance and certification to ensure their end product qualifies under the EU’s ReFuelEU Aviation regulations. They are taking a flexible approach to securing CO2 supplies at the moment, but are in active discussions with nearby emitters across their portfolio of sites for future carbon capture plants and would even consider co-development. They see Direct Air Capture (DAC) as a viable CO2 source in the long term.

Challenges

Norsk e-Fuel faces some hurdles in its quest to industrialise e-fuel production, primarily related to infrastructure, the availability of carbon dioxide as a feedstock and financing:

- Power access: Although Finland offers fossil-free electricity, securing grid integration for large industrial plants is complex and time-consuming.

- CO₂ sourcing: Norsk e-Fuel is pursuing a “liquid CO₂ strategy,” avoiding dependency on a single co-located supplier. This increases long-term resilience and flexibility in a developing market but adds logistical (transportation) and contractual complexity (multiple suppliers). The largest challenge remains however the long lead time of capture projects on the emitters side making CO2 an available resource.

- Financing: PtL projects are capital-intensive. Norsk e-Fuel uses a special purpose vehicle (SPV) model at plant level, raising equity for each project while retaining a stake at company level. Competing with larger incumbents for state funding mechanisms such as the EU Innovation Fund support is challenging.

- Technology scale-up: Moving from small pilots to an 80 ktpa facility requires proving reliability and cost efficiency at a scale not yet achieved in Europe.

Partnerships and financing

Partnerships are at the heart of Norsk e-Fuel’s approach. Its founding consortium provides credibility and technical expertise. Strategic investors such as Prime Capital, Tesi (Finnish sovereign fund) and Lux Airport signal confidence in both the technology and its market potential. Offtakers including Norwegian Air Shuttle, Boeing and Cargolux have signed agreements that are location-agnostic, giving the airlines flexibility to direct volumes from whichever project comes online first.

This diversified offtake model reduces risk for all parties and ensures that delays at one site do not derail progress elsewhere. The SPV financing structure spreads risk between project investors and the company, while retaining ownership stakes to reinvest in the next wave of plants.

At Rauma, cooperation with Fortum and the municipality has been key. Early backing from local authorities and the port accelerates planning and builds confidence in the project’s social licence to operate.

Lessons learnt

Norsk e-Fuel’s journey so far provides several lessons for other early-stage projects:

- A diverse portfolio builds resilience: Developing multiple sites in parallel ensures that setbacks in one project do not stall overall progress. Planning, communication and the optimal time buffer between sites are crucial so that lessons learnt can be passed on to the next project.

- Local engagement is foundational: Active support from municipalities and ports can speed up permitting and bolster public trust.

- Flexibility matters: Location-agnostic offtake agreements and a flexible CO₂ strategy reduce exposure to single suppliers or sites, making projects more investable.

- Financing structures must adapt: Separating the plants out as Special Purpose Vehicles (SPVs) has allowed for equity investment and debt raising at the company level, spreading risk, but highlights the need for innovative funding mechanisms and supportive policy to level the playing field for smaller developers.

- First movers shape the market: Early projects like Rauma can play a crucial role in proving viability and setting precedents that others will follow.

A diverse project pipeline is essential – by developing multiple sites simultaneously and decoupling offtake agreements from specific locations, Norsk e-Fuel has mitigated the risk of delays.

— Luisa Biesold

Norsk e-Fuel Head of Corporate Development

Looking ahead – a portfolio model as blueprint

Project Rauma, along with its sibling Project Alby in Sweden, is an important step in Norsk e-Fuel’s effort to industrialise power-to-liquid technology and deliver sustainable aviation fuel at scale. By advancing four commercial scale e-SAF projects in the Nordics concurrently, the company is demonstrating how Europe can decarbonise aviation while strengthening energy security and unlocking economic opportunity for the region. Both Project Rauma and Project Alby are expected to reach FEED stage in 2026 and final investment stage by 2027 to be operating in the early 2030s.

If successful, Rauma will not only provide cleaner fuel for Europe’s skies but also serve as a blueprint for replicating PtL production across industrial clusters around the world.