Meranti Green Steel

Meranti Green Steel is spearheading green steel development in Asia-Pacific.

Building a cross-border model for low-carbon steel in Asia

Meranti Green Steel is spearheading green steel development in Asia-Pacific. By splitting its business model between Oman and Thailand, the company is charting a new way to build value chains that support the clean steel transformation. Building on strong partnerships and a profitable business case, Meranti is on track to reach a Final Investment Decision (FID) by mid-2026.

| KEY FACTS | |

|---|---|

| Official project name | Meranti Green Steel |

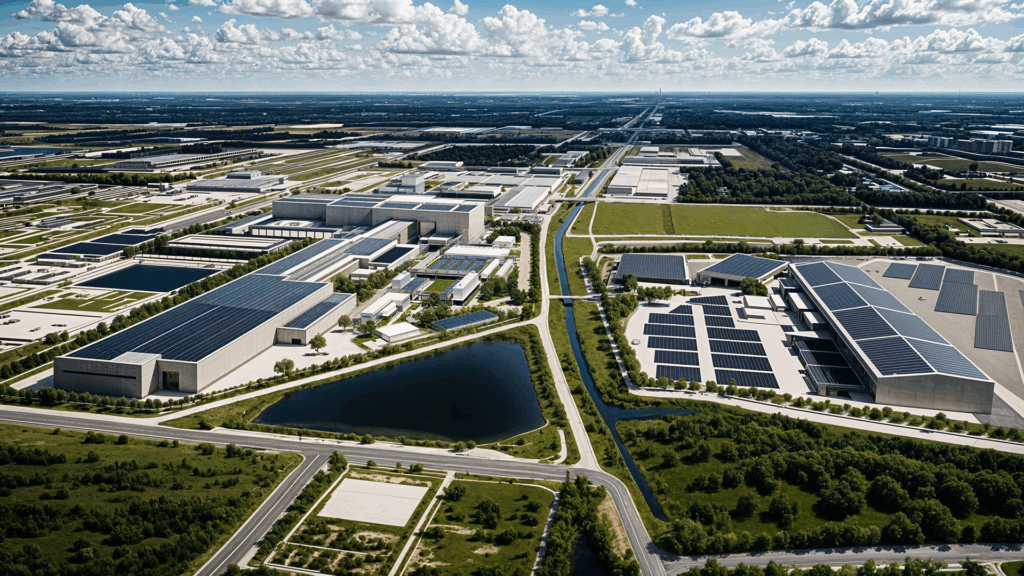

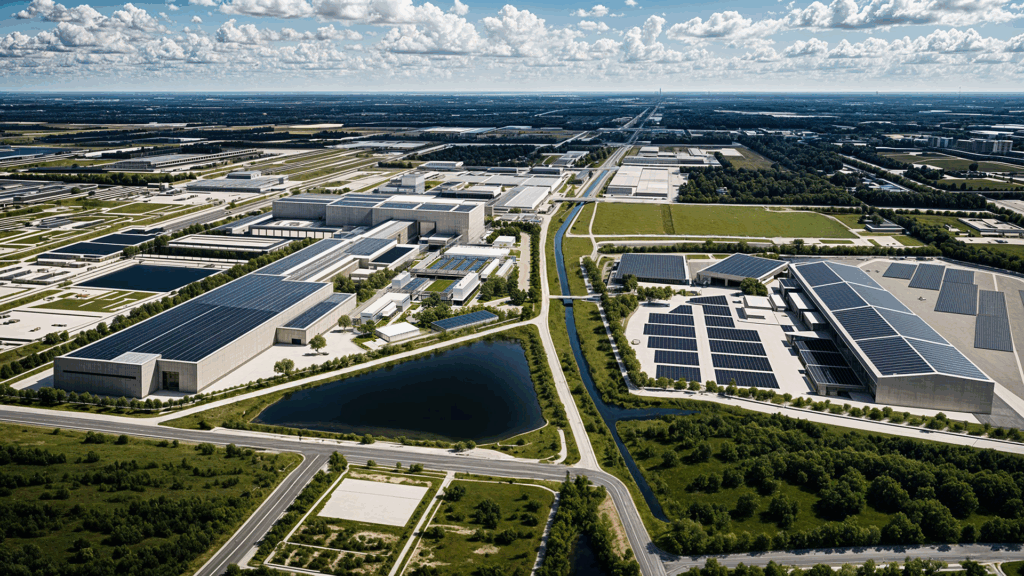

| Location | Duqm, Oman (DRI/HBI plant) and Rayong, Thailand (EAF steel plant) |

| Project stage | Moving towards FID |

| Sector | Steel |

| Customer | N/A |

| Total Project investment | Around $3bn USD |

| Jobs | N/A |

| Capacity | 2.5 Mtpa of Hot Briquetted Iron (HBI) in Oman, 2.5 Mtpa of steel in Thailand |

| Key milestones | – Meranti Steel founded in 2016 – Meranti Green Steel founded in May 2023 – HBI project in Oman announced in August 2025 – FID expected by mid-2026 – Commissioning expected by mid-2029 |

Project and company vision

In 2023, Meranti Steel announced the creation of Meranti Green Steel, a clean spin-off business. While many new steel projects in the region were still planned around conventional blast furnace routes, Meranti set out to develop a model that could help shift the Asia-Pacific steel sector towards a lower carbon future.

East and Southeast Asia host many Original Equipment Manufacturers (OEMs), particularly for the automotive industry, that depend on reliable quality steel supply. Meranti Green Steel was founded on the conviction that this demand, combined with advances in global climate policies, would form the foundation of a strong market for low-carbon high grade steel.

Its flagship project has made the strategic decision to split the ironmaking and steelmaking stages into two locations: Ironmaking will take place in Duqm, Oman, with the steelmaking taking place in Rayong, Thailand.

Project design and business model

The 2.5 Mtpa direct reduction plant in Oman will initially run on natural gas and a smaller portion of green hydrogen before transitioning to a majority share of green hydrogen. The output – Hot Briquetted Iron (HBI) – is a “transportable” form of reduced iron, which will be partly shipped to feed a 2.5 Mtpa Electric Arc Furnace (EAF) in Thailand, while the remainder will be sold externally, notably to Europe.

The newly-built EAF in Thailand is expected to run on up to 100% renewable electricity while the input feedstock will be about half HBI, half steel scrap.

Market positioning

Natural gas-based steel is already more than half as emissions-intensive as conventional blast furnace routes. With a clear ramp-up plan of green hydrogen – starting at around 25% in 2030 and reaching close to 100% in 2045 – Meranti is taking an innovative, yet pragmatic approach in line with global emission reduction pathways needed to reach global emissions reductions targets.

Thailand, once a steel heavyweight in Southeast Asia, has become a major steel importer. Revitalising its steel sector with a modern, low-emissions EAF plant producing high grade steels has therefore been warmly welcomed by Thai authorities. The project is also strategically located close to high-value downstream industries which rely on steel, and some of which are direct exporters to Europe. As the EU’s Carbon Border Adjustment Mechanism (CBAM) is poised to include more downstream products in future, Meranti is aiming to secure a first-mover advantage as a low-carbon high grade steel supplier in Asia.

Realism is very important on the project and investor side, but also on the government side in setting decarbonisation targets. Decarbonising the iron and steel industry is complex and will take time.

— Sebastian Langendorf

CEO of Meranti Green Steel

Progress and milestones

The project is on track towards its goal of a Final Investment Decision (FID) by mid-2026 and expects to start the Front End Engineering and Design (FEED) study in late 2025. An important milestone was achieved in July 2025, when Omani authorities confirmed natural gas allocation for the DRI/HBI plant – a critical step in ensuring a reliable starting point, ahead of a transition to green hydrogen.

When entering this business, Meranti rapidly sensed market traction for low-carbon steel and HBI underpinned by tightening climate policies and corporate commitments. That offtake appetite has already materialised. By mid-2025, Meranti had signed agreements covering around half of its future production, with buyers willing to pay a certain premium for low-carbon steel and HBI.

Key challenges and success factors

Finding the right business model

Originally, the project was designed to be fully integrated in Thailand, from ironmaking to steelmaking. Because of energy costs, Meranti saw a strong economic benefit in splitting the value chain and outsourcing the ironmaking stage to Oman, where cheap energy and green hydrogen potential make clean DRI/HBI production a viable proposition.

We see strong interest for low-carbon HBI from European steelmakers, but also more globally which confirms our approach.

— Sebastian Langendorf

CEO of Meranti Green Steel

Partnerships & People

Meranti’s 10 years of presence in the region provided a strong foundation of industry networks and engineering expertise. The company has worked closely with Omani and Thai authorities, a leading iron ore supplier, technology providers and potential steel customers. These relationships have been crucial in building credibility and progressing the project.

The company’s vision is not only attracting investors and customers, but also talent. When recruiting in both countries, Meranti was pleasantly surprised to notice much enthusiasm – especially from young people – who see purpose in working on clean industrial solutions. Meranti’s strategy has been to bring in highly-skilled people from the start and is collaborating with local universities and technological colleges to train and hire future graduates.

We have a lot of interest from young people to join the business because they see green steel as providing purpose.

— Sebastian Langendorf

CEO of Meranti Green Steel

Finance gap

Despite the solid business case, financing remains a challenge. As a new market entrant without established banking relationships, Meranti Green Steel is continuously raising equity to cover early stage engineering and reach FID.

Lessons learnt

While the project has yet to reach FID, Meranti’s journey so far has generated several valuable insights:

- Flexibility improves resilience: Pivoting from an integrated Thai project to a dual-location Oman-Thailand model allowed Meranti to optimise its supply chain while maintaining a long-term near zero goal with delivery of short-term results.

- Policy remains central: Ultimate success for projects like Meranti Green Steel hinges on robust climate policies (e.g. CBAM, CO2 pricing, demand mandates) and delivery on their commitments.

- Demand exists: Early offtake agreements show that low-carbon steel projects can secure a premium in global markets.

- Partnerships maintain momentum: Engagement with governments, suppliers, technology partners and potential partners have driven the project.

- Talent is a bright spot: Interest from young professionals in green steel adds to the long-term viability of clean industrial projects.

- Finance remains the bottleneck: New entrants to emerging supply chains need effective and innovative financing approaches to overcome first-mover barriers.

Looking ahead

Meranti Green Steel is now confident in its business model. Its projects in Oman and Thailand can serve as a blueprint to replicate the same structure in other locations in APAC. For example, Meranti has partnered with Green Steel WA in Western Australia to develop a new green ironmaking facility. Green iron would then be exported and processed into steel in locations beyond Thailand, e.g. Indonesia.