First Ammonia

First Ammonia is building a 250 kt/y green ammonia project in Texas as a replicable model, securing early offtake and demonstrating competitive commercial viability.

First Ammonia combines pragmatism and ambition, recognising that large-scale clean projects will only succeed if their product can be made competitively. Its first project in Texas is being developed to demonstrate exactly that – navigating regulatory and market uncertainty while building a replicable model that can guide future investment in green ammonia across the world.

| KEY FACTS | |

|---|---|

| Official project name | First Ammonia |

| Location | Victoria, Texas (first project), with expansion sites under study in other geographies |

| Project stage | Completed Front End Engineering and Design (FEED), moving towards Final Investment Decision (FID), which First Ammonia refer to as Financial Close (FC) |

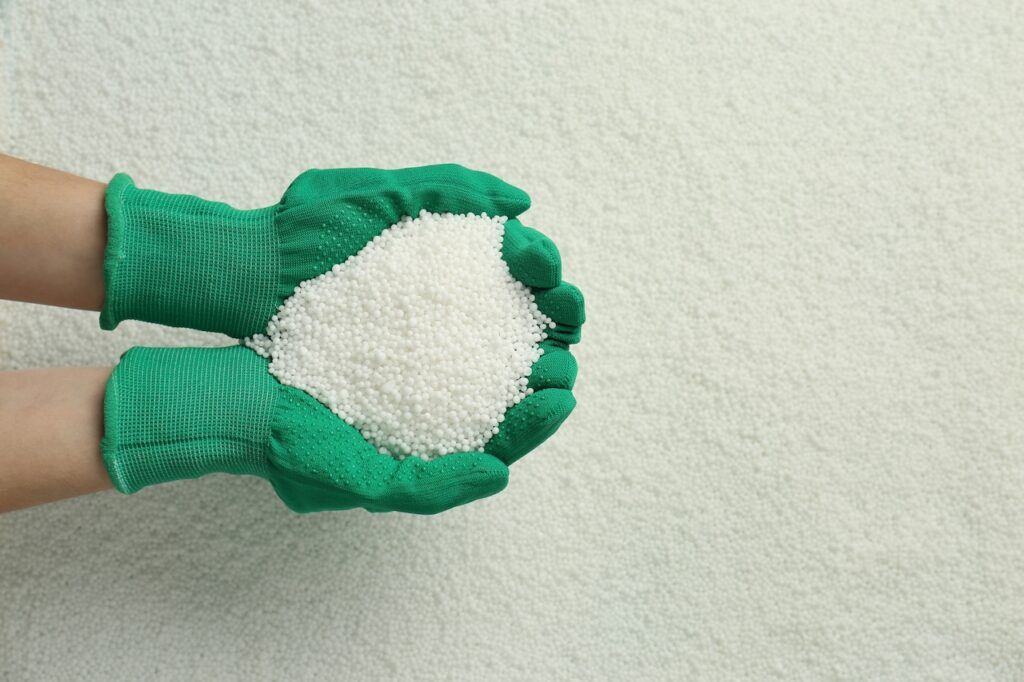

| Sector | Clean fuels, green ammonia |

| Customer | Early-stage offtake agreements have been made with European wholesale buyers covering a variety of end-products including fertiliser and chemicals. Demand as a shipping fuel is expected in the near future |

| Capacity | ~250 kt/y of green ammonia |

| Key milestones | • Company founded in 2022 (from Aquamarine Investment Partners) • Made a reservation for solid oxide electrolyser capacity from Topsoe in 2022 • Raised B series funding in 2024 • FEED completed in 2025 • FID for Victoria expected in 2026 |

Founding vision

First Ammonia was conceived during the pandemic with a simple yet ambitious idea: build not just a single project, but develop a model for scalable clean ammonia production that can operate in different geographies. The company’s founders believed genuine decarbonisation would only succeed if low-carbon solutions could be delivered on a commercially viable basis.

These projects don’t get done because they’re a good idea. They get done because they make economic sense. We saw that the green ammonia industry had the potential to be a business unto itself, regardless of one’s views of the social or environmental impact

— Joel Moser

CEO, First Ammonia

Green ammonia, which is chemically identical to conventional ammonia but is produced without fossil fuels, offered that opportunity. Their approach was to design projects that financially resembled traditional infrastructure investments, offering predictable costs, long-term offtake contracts and steady returns.

Project motivation

From the outset, the motivation was strategic and economic. Ammonia is already a globally traded commodity vital for fertilisers and industrial chemicals, and it could also serve as a future fuel for shipping and energy storage. This versatility makes it uniquely positioned to drive a clean fuels transition.

Policy frameworks reinforced this opportunity. In Europe, carbon reduction policies created the first significant demand for clean ammonia. Later, the US Inflation Reduction Act introduced powerful incentives in the form of tax credits for hydrogen production, enabling lower production costs for ammonia. Taken together, these measures meant that governments were effectively creating the market.

The Texas project – with an electrolyser capacity of around 300 MW, producing around 250,000 tonnes per year – was designed to strike a balance between economies of scale and bankability. Crucially, the development process is modular, meaning the project can be replicated globally.

The benefits of being a first mover

- Credibility with partners and regulators: the early development work and partnership with Topsoe’s electrolyser technology established technical competence at a time when most competitors had only made announcements.

- Market position: years of groundwork with potential buyers and regulators means First Ammonia is well placed to secure long-term sales once projects come online.

- Replicable design: engineering, permitting and financing efforts in Texas will form a blueprint for future sites in other regions.

- Standard-setting: by moving early, the company can shape the structure of offtake contracts and project financing, setting precedents that others will follow.

But first-mover status has required resilience. The company entered the market without state backing, instead relying on vision, persistence and carefully cultivated partnerships.

This project needs to be developed on a project finance basis where every element of the project is de-risked to have a predictable, credible revenue stream. It won’t be this way forever. It’s abundantly clear that this is a growing market and I hope by the mid-2030s that it will be possible to finance and raise equity to build projects which would enable us to capture more of the upside value of this product in the market.

— Joel Moser

CEO, First Ammonia

Challenges along the way

- Regulatory uncertainty: U.S. rules on how renewable electricity must be sourced to qualify for subsidies delayed progress for almost two years. Although global offtake is desirable, the differing regulation of clean fuels across markets makes it more complex.

- Market timing: the war in Ukraine caused a disruption to power prices and forced a pivot from Germany to Texas. While the Inflation Reduction Act created strong incentives in the US, these shifts required agility and rapid adjustment.

- Financing as a newcomer: without legacy capital, securing early-stage capital required visionary backers who were willing to commit before the market had fully formed.

- Technology risk: As an early adopter of Solid Oxide Electrolysis Cell (SOEC) technology, the company had to accept performance risk without the benefit of multiple reference plants. Working with a technology partner who understands this and can provide certain performance guarantees is crucial to getting a first-of-a-kind project financed.

There should be a single global standard of what is zero-carbon e-ammonia. There should be a global book and claim system. The production of a molecule of green ammonia anywhere in the world reduces the amount of carbon, regardless of the regulatory geography.

— Joel Moser

CEO, First Ammonia

Despite these challenges, First Ammonia has remained on track, with FID for the Texas project expected by 2026.

When we get to financial close, it will be a tightly constructed transaction that will provide returns to its investors at the same terms as an LNG or a coal plant, because that’s what the markets require.

— Joel Moser

CEO, First Ammonia

Lessons learnt

- Projects must be economically sound: Climate arguments alone do not attract investment. Bankability, stable returns and clear risk allocation are what make projects fundable. First Ammonia believes the 300 MW plant is the ‘sweet spot’ for project size vs price point.

- The first mover has a competitive advantage: early work in engineering, partnerships and building credibility pays dividends later, even if it is harder to start with.

- Policy creates markets: without strong regulation and incentives, clean fuels will not reach scale. Aligning with policy frameworks is essential.

- Flexibility beats perfection: adapting quickly to changes in regulations, energy prices or geopolitics is more important than finding the ‘perfect’ location for a project. While renewables will power the plant, the company is keeping an open mind about the development of small modular reactors as a future source of energy.

- Trusted partnerships matter most – from technology providers to regulators and financiers.

First Ammonia is now eyeing up potential sites for the next projects with possible locations ranging from South America to Northern Europe and Asia, following the availability of cheap renewable power.