Stegra

Stegra is transforming the future of low-carbon steel production with its hydrogen-powered facility in Boden, Sweden.

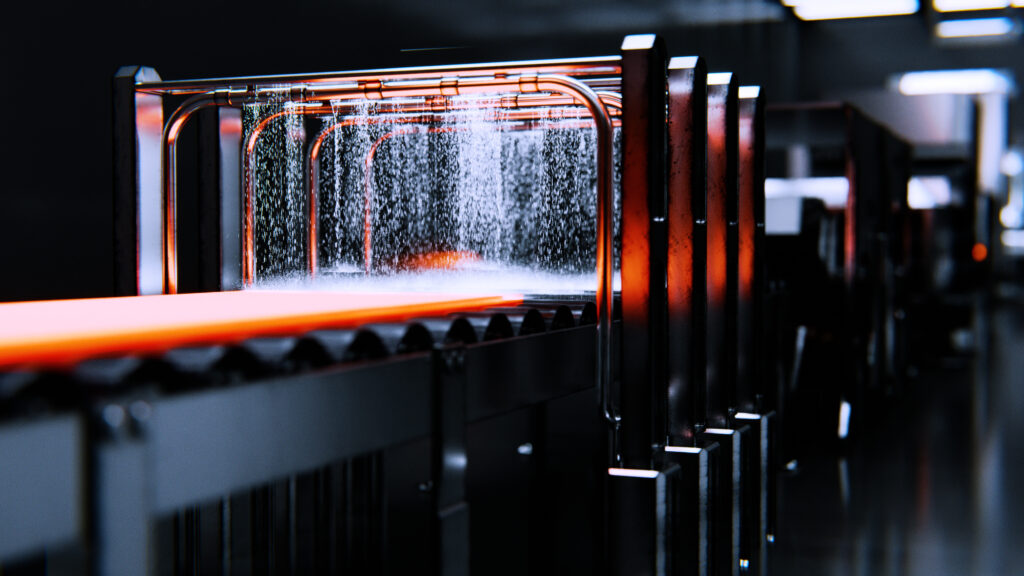

As the world’s first large-scale plant for near-zero-emission steel and Europe’s first greenfield steel mill in 50 years, the Stegra plant in Boden, Sweden, is forging a new future for steelmaking. In addition to its fully-integrated process of green hydrogen production, direct reduction of iron, and steelmaking all on one site, Stegra has also innovated with novel industry offtake agreements and financing approaches.

| KEY FACTS | |

|---|---|

| Official project name | Stegra |

| Location | Boden, Sweden |

| Project stage | Under construction (phase 1) |

| Sector | Steel |

| Customer | Offtake agreements with 20+ customers, including Mercedes-Benz, Porsche, Volvo Group and IKEA |

| Total project investment | €6.5 billion |

| Jobs | 4,700 total direct (2,000) and indirect (1,700) jobs created across Sweden |

| Capacity | 700 MW electrolyser, 2.1 million tonnes per annum (Mtpa) of direct reduced iron (DRI) & 2.5 Mtpa steel for phase 1, aiming for phase 2 with 5 Mtpa of steel by 2030 |

| Key milestones | • Founded 2020 • Full environmental permit June 2023 • Final investment decision for phase 1 January 2024 • Production start targeted for 2026 |

Founding vision

Green steelmaker Stegra emerged from the vision of the Swedish founder company, Vargas, which, 10 years ago, was taking a closer look at Europe’s decarbonisation ambitions. They knew car companies were starting to realise the steel used in their cars was the next thing that would have to be decarbonised after fuel: Steel is one of the most significant sources of embodied CO2 in vehicle manufacturing (between 15 to 30%), and its wider use is responsible for more than 7% of global emissions.

Our founders realised, this is a gap in the market that nobody in Europe is looking at.

— Luisa Orre

Chief Business Development Officer, Stegra

The different technologies needed for clean steel production already existed and had been successfully piloted in Sweden’s HYBRIT project, albeit separately rather than as the complete end-to-end process. The challenge Stegra has overcome is bringing all the pieces in the system together to work in harmony (i.e. hydrogen electrolyser, direct reduction plant and electric arc furnace). It has foregone the traditional step of using natural gas for heating and has instead integrated electricity to pre-heat the reducing gas in the plant. The final process employed for the steelmaking is similar to mini-mills already widely used in the US.

Stegra saw a market opportunity in pioneering large-scale green steel production in Europe. The transition between earlier phases of the EU’s Emissions Trading System (ETS) and the phasing in of the Carbon Border Adjustment Mechanism (CBAM), leading to the end of ‘free carbon allowances’ contributed to this market creation. H2 Green Steel was founded in 2020 and became Stegra in September 2024.

Pioneering on a commercial scale

Stegra chose Boden in northern Sweden for its flagship plant given the area’s cheap, clean electricity and proximity to good quality iron ore. The H2-DRI plant, currently under construction, includes 700MW of electrolyser capacity, producing green hydrogen to create 2.1 Mtpa of DRI and 2.5 Mtpa of steel – enough steel for around three million car bodies( ) or 30 Golden Gate bridges. Along with DRI, the plant will also use steel scrap as raw material.

Stegra expects to begin production in 2026 and, in a second, as-yet-unfunded phase, aims for 5 Mtpa of steel production by 2030.

Key challenges and success factors

With a first-of-a-kind (FOAK) green steel project, Stegra faced the perennial challenge of finding investors who could be convinced to fund the €6.5 billion needed for the project. Their success was enabled by the fact that the project aligned with the needs of a mature automotive industry from the outset.

This enabled them to face down another challenge: changing the business model of selling steel, from traditional sales in a commodity market to directly contracting long-term offtake agreements with a green premium.

Premium offtakers

Stegra found willing offtakers, largely in the premium end of the European automotive industry, customers for whom a 25% green premium on an electric vehicle’s steel components would make business sense. For the end consumer, an overall price increase of around €500 on a product that, for the luxury brands, retails anywhere between €100,000 to €250,000 is not considered material. At the point of manufacturing, carbon costs for grey steel have been increasingly shown as an itemised line on invoices since 2023. Additionally, in line with the introduction of CBAM, from 2026, European steelmakers will start paying for emissions.

As of November 2024, Stegra had secured around 1.5 Mt/y of steel in offtake agreements – ~60% of its production – across 20 binding long-term agreements with companies such as Mercedes-Benz, Porsche, BMW, Volvo Group, IKEA and Scania.

Starting with securing a solid customer order book set Stegra up well for securing project finance in the form of both equity and debt.

Investor confidence

With guaranteed revenues from offtake agreements of up to seven years, Stegra was able to demonstrate the bankability of its project to investors. In total, they have raised €6.5 billion, with about two-thirds of it as debt across bank consortia, but also unlocking higher levels of equity investment than is typically the case for an energy-intensive start-up.

We were able to create a financing package of that scale, thanks to equity investors that are looking for ways to deploy capital into decarbonisation.

— Luisa Orre

Chief Business Development Officer, Stegra

Stegra’s steel offtake agreements work similarly to the Power Purchase Agreements used in the renewable energy sector. They guarantee revenues and so, in a way, act as collateral for their lenders.

Further factors which derisked the project in the eyes of funders included the proof of concept exhibited by the HYBRIT project, boosting confidence in the technologies behind green steelmaking and the benefits of building an entirely new site.

Developing Europe’s first brand-new steel plant in 50 years, one that is highly digitalised, electrified and very energy efficient, also boosted confidence in Stegra’s ability to compete with incumbent steelmakers.

Partnerships and early engagement

Careful consideration of timings, building internal flexibility and early dialogue across stakeholder groups is cited by the Stegra team as crucial to its progression.

On a practical level, contracts that give the team some room for internal adaptation on timings are important, for offtake agreements and also with suppliers, for example, electricity or other consumables, construction terms or finance agreements.

Interdependencies between contracts are unavoidable on a project of this size and Stegra has dedicated time and effort into forming partnerships across the value chain to minimise the risks from one contract failing.

Early engagement and ongoing dialogue with local stakeholders has also been fundamental to the project. The new plant will sit alongside the local community within the municipality of Boden, close to homes and schools. For Stegra, ensuring good relations with their neighbours has smoothed the way for permitting and the influx of construction workers needed to complete the project. Starting conversations early with public bodies and regional governments is vital, as these negotiations can take longer than expected. The project already brings wide socio-economic benefits to the Boden region, but is also predicted to positively impact the Swedish GDP.

Adapt to changing stages

Having the right people and the composition of the team, depending on the project stage, is central to Stegra. A strong and coherent vision from the beginning made it easier to attract talented people at the start of the project. Early joiners to the organisation worked across many roles, but as the company matured and the action of building one of Europe’s largest industrial projects began, additional team members with decades of specific experience in delivering huge industrial projects were needed.

Learnings from the Boden project are already shaping Stegra’s future project strategy and long-term expansion plans. While the Boden project will be fully integrated from hydrogen production to steelmaking, the company’s future plans may focus on becoming a supplier of green iron to the established steel industry. It sees itself as an enabler for steel plants that cannot easily decarbonise their own ironmaking process because of a lack of nearby renewable sources.

Although Stegra is laying the groundwork for future projects in Portugal, Brazil and Canada, the company’s primary focus is on delivering the Boden project for production to begin in 2026. The Boden plant could then be presented as a full-scale commercial demonstrator of the H2-DRI concept.

If we can create something in the intersection between traditional industry, new technologies, electrification and decarbonisation, that’s also beneficial, because of the positive follow-on effects, follow-on startups, follow-on innovation, and that’s in everything from hydrogen production, electricity generation to digitising a manufacturing plant. This could be a test bed for a lot of just modern industry, or what some people might call industry 4.0.

— Luisa Orre

Chief Business Development Officer, Stegra